- Weekly Wizdom

- Posts

- Monthly Report: August 2025

Monthly Report: August 2025

United States

Macro-wise, this month we had mixed data with a miss in non-farm payrolls (73K vs. 110k expected), constant unemployment at 4.2%, stable inflation (2.7% year-on-year), but a slight uptick in Core inflation (by 0.1% for month-on-month and year-on-year) and an upside move in the PPI (0.9% vs. the 0.2% expected). PMIs disappointed, with manufacturing printing at 48 (down from 49 in the previous print and 49.4 expected), while services held at 50.1 (down from 50.8 in the previous reading and the 51 forecast). US GDP growth and Retail sales were the bright spots, coming out at 3.3% vs. 3% expected quarter-on-quarter and 0.5% Vs 0.4% month-on-month, respectively. The main event was Jackson Hole, where the FED appeared to pivot towards growth as a priority vs. inflation.

All eyes are on interest rates, which dictate the direction of the housing market moving forward. Mortgage rates retreated during August, with the 15-year mortgage down 15 basis points and the 30-year mortgage dropping by almost 20 basis points.

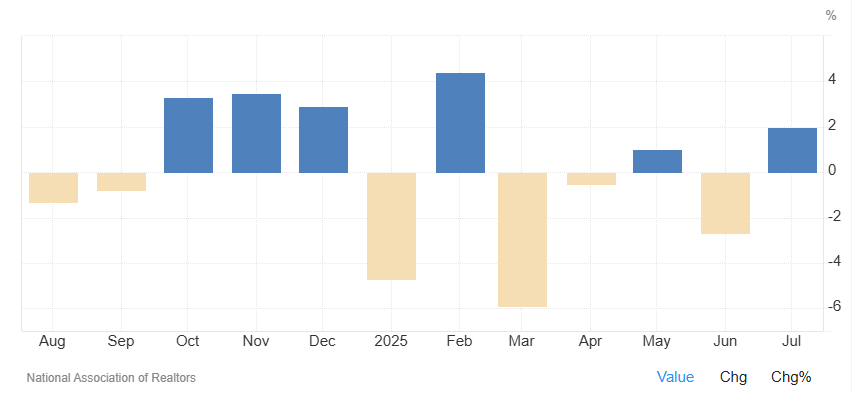

Existing home sales increased by 2% month-on-month to an annualized rate of 4.01m for July, marking the sharpest increase since February and beating the 3.92m forecast. Notably, this reversed the decline seen last month. Median prices for existing home sales also increased by 0.2% year-on-year to $422,000. Despite slightly lower mortgage rates, existing home sales remain at the lower end of the year's range.

Existing Home Sales. Trading Economics, 2025

Existing Home Sales MoM. Trading Economics, 2025

For new homes, sales dropped by 0.6% from the previous month to an annualized rate of 652k for July, however, beating the 630k that was expected.

New Home Sales MoM. Trading Economics, 2025

New Home Sales. Trading Economics, 2025

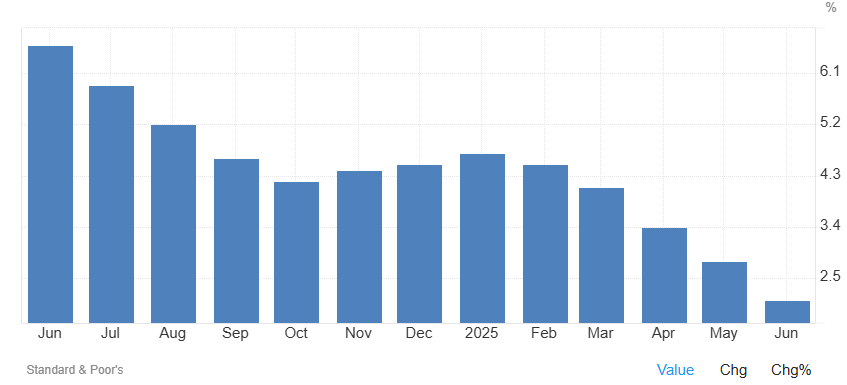

Case Shiller Home Price Index YoY. Trading Economics, 2025

The Case-Schiller 20-City Home Price Index rose 2.1% year-on-year for June, exhibiting slower growth from the 2.8% year-on-year recorded for May. This was the softest increase since the summer of 2023. Housing inventory remains strong as mortgage rates remain high and housing starts are healthy. Total housing remains at its high since the COVID-19 pandemic.

United Kingdom

Firstly, the BoE kept rates unchanged as expected at the start of this month. This was a good month for the United Kingdom, with unemployment remaining stable at 4.7% while inflation rose to 3.8% year-on-year (by 0.2%), in line with forecasts. GDP exceeded expectations and grew by 0.3% quarter-on-quarter (vs. 0.1% forecast), by 1.2% year-on-year (vs. 0.7% forecast), and by 0.4% (vs. 0.4% forecast). Services PMI outperformed as well, coming out at 53.6, exceeding the 51.9 of the previous month and the 51.7 forecast.

Manufacturing PMI continues to disappoint, as the main sour print of this month – coming out at 47.3, missing the 48.6 forecast and remaining in contraction territory. Importantly, we have seen manufacturing PMIs in Europe improving recently, but the UK’s hasn’t followed. The Construction PMI for the UK was the main disappointment, dropping to 44.3 in July 2025 from 48.8 in June, which constitutes the largest decrease since May 2020. The areas hit the most in terms of confidence have been across civil engineering and residential building, where there is evidence of weaker demand and a series of delays.

United Kingdom Construction PMI. Trading Economics, 2025

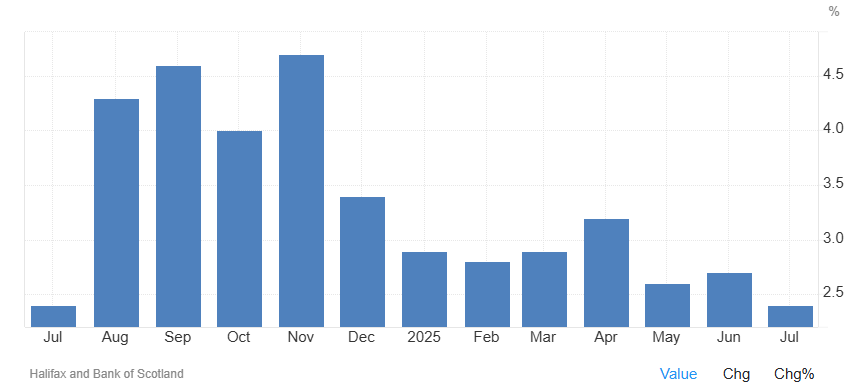

Looking at housing, the market appears to be supported by a slight improvement in affordability due to wage growth and mortgage rate decreases; however, the overall readings remain mixed. The Halifax House Price Index in the UK rose 0.4% month-on-month, beating the 0.3% forecast. The Index rose by 2.4% year-on-year, easing from the 2.7% increase in June and marking the softest increase since July 2024. The average property value increased to £298,237, from £297,157 in June.

Halifax House Price Index YoY. Trading Economics, 2025

Halifax House Price Index MoM. Trading Economics, 2025

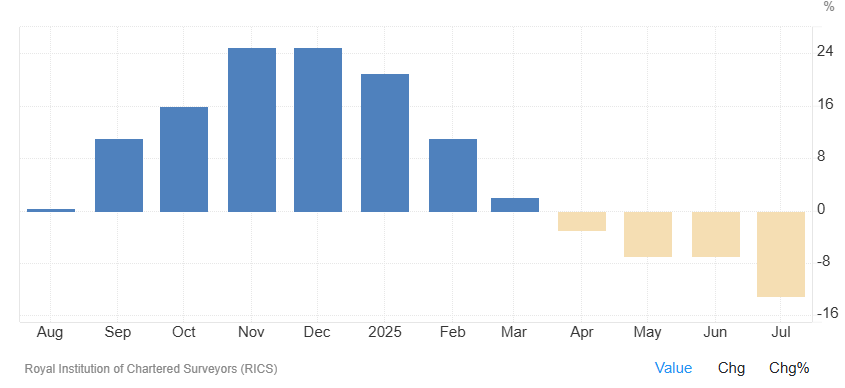

The RICS Market Survey showed the balance dropping to -13% for July, a decrease from the -7% recorded in June. This is the weakest reading in over a year and represents a significant miss of the -5% market expectation. This also marks the 4th consecutive negative reading. Having said that, the survey showed that overall confidence in the housing market improves on a longer time horizon (year-ahead view).

RICS House Price Balance. Trading Economics, 2025

China

Macro-wise, both industrial production and retail sales showed softer year-on-year growth compared to expectations and previous readings. Retail sales are up 3.7% year-over-year, compared to 4.8% for the previous month and a forecast of 5%. Industrial production came out 5.7% higher year-on-year, missing the 6.8% of the previous month and 6.4% expected. Exports data was the bright spot, at 7.2% vs. the 5.1% forecast, although there might still be front-loading in anticipation of further tariffs. Finally, inflation was flat year-on-year, a slight improvement from the minor forecasted deflation (-0.1%).

China Industrial Production. Trading Economics, 2025

China’s new home prices were down by 2.8% year-on-year for July, easing once again from a 3.2% drop in the previous reading. This now marks the 25th consecutive month of year-on-year declines in house prices. This is also down 0.3% month-on-month, highlighting the continued weakness in the property market. Having said that, we are currently at the softest contraction in more than 18months.

China Newly Built House Prices YoY Change. Trading Economics, 2025

WANT MORE?

We’ll make it easy for you! Upgrade to Premium and gain an edge in the markets with industry-leading insights and analysis.

References

(n.d.). US Treasuries Yield Curve. US Treasuries Yield Curve. https://www.ustreasuryyieldcurve.com/

(n.d.). CME FedWatch Tool. CME Group. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

(n.d.).Trading Economics. Trading Economics. https://tradingeconomics.com/united-states/nahb-housing-market-index

(n.d.).Goldman Sachs. Goldman Sachs. https://www.goldmansachs.com/

(n.d.).Bloomberg. Bloomberg. https://www.bloomberg.com

(n.d.). FRED. Federal Reserve Economic Data. https://fred.stlouisfed.org/

Disclaimer

Wizard of Soho LLC and Weekly Wizdom publish financial information based on research and opinion. We are not investment advisors, and we do not provide personalized, individualized, or tailored investment advice, nor do we provide legal advice or information. The publisher does not guarantee the accuracy of the information provided on this page. All statements and expressions present are based on the author's or paid advertiser's opinion and research. Directly or indirectly, no opinion is an offer or solicitation to buy or sell the securities or financial instruments mentioned.

As news is ever-changing, the opinions included should not be taken as specific advice on the merits of any investment decision. Investors should pursue their investigation and review of publicly available information to make decisions regarding the prospects of any company discussed. Any projections, market outlooks, or estimates herein are forward-looking and inherently unreliable. They are based on assumptions and should not be construed to be indicative of actual events that will occur.

Contrarily, other events that were not considered may occur and significantly affect the returns or performance of the securities discussed herein. The information provided is based on matters as they exist on the date of preparation and do not consider future dates. As a result, the publisher undertakes no obligation to correct, update, or revise the material in this document or provide any additional information. The publisher, its affiliates, and clients may currently or foreseeably have long or short positions in the securities of the companies mentioned herein. They may, therefore, profit from fluctuations in the trading price of the securities. There is, however, no guarantee that such persons will maintain these positions. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile, or any other means is illegal and punishable.

Neither the publisher nor its affiliates accept any liability for any direct or consequential loss arising from any use of the information contained herein. By using the website or any affiliated social media account, you consent and agree to this disclaimer and our terms of use.