- Weekly Wizdom

- Posts

- Monthly Report: January 2026

Monthly Report: January 2026

United States

Macro data released during January continued to paint a mixed picture for the US economy. Inflation data showed further moderation, while labour market indicators softened modestly. Growth momentum remains resilient, although forward-looking indicators suggest a gradual cooling in activity. Overall, the macroeconomic backdrop remains consistent with a cautious bias toward easing by the Federal Reserve, albeit with policymakers signalling patience.

On the labour front, the latest non-farm payrolls report released in January showed job growth slowing further, coming in slightly below expectations. Previous months were also revised slightly lower, reinforcing the view that labour market tightness is gradually easing. The unemployment rate edged back to 4.4%, however, from 4.5% for November. Expectations regarding job availability weakened substantially, suggesting that households are becoming more cautious despite still-solid income growth.

Inflation data released in January showed headline CPI rising 2.7% year-on-year, while core CPI stayed at 2.6%. Both readings came broadly in line with expectations and marked the lowest inflation prints since early 2021. On a monthly basis, price pressures remained contained, with inflation in shelter and services continuing to slow. Producer price inflation surprised to the upside, driven mainly by services, but it remains well below the peaks seen earlier in the cycle.

Business activity indicators remained expansionary. Flash PMIs for January showed services activity continuing to grow, while manufacturing edged back toward the expansion threshold. Input cost pressures eased slightly, though output prices remained elevated relative to pre-pandemic norms. Retail sales were up 0.6% month-on-month, beating the 0.3% forecast, while personal spending keeps accelerating, at 0.5% growth month-on-month vs. the 0.1% expected.

Housing data released during January overall remained relatively uneventful, with existing home sales the main outlier, which came out very strong, while new home sales stayed somewhat stable, and mortgage rates were unchanged.

Existing home sales rose 5.1% month-on-month, continuing strong with their recent trend and marking the highest level in nearly three years, although activity remains below the pre-high interest rate environment.

Existing Home Sales. Trading Economics, 2026

Existing Home Sales MoM. Trading Economics, 2026

Sales of new homes were off by 0.1% from the previous month; however, they are roughly where they were in September, which was the highest level in more than two years.

New Home Sales. Trading Economics, 2026

The Case-Shiller 20-City Home Price Index rose 1.3% year-on-year for November, the smallest annual increase since mid-2023. Although house prices are appreciating, they are lagging inflation at this stage.

Case-Shiller 20-City Home Price Index YoY. Trading Economics, 2026

Mortgage rates were broadly stable through January, with modest volatility around the January FOMC meeting. The 30-year mortgage was down by 5 bps while the 15-year mortgage was up by 5 bps.

United Kingdom

UK macroeconomic data released in January indicated a mixed picture once again. Inflation was the main worry, as it rose to 3.4% year-on-year from 3.2% previously and the 3.1% forecast. On the other hand, GDP and retail sales grew month-on-month by 0.3% and 0.4% respectively, beating their expectations and previous readings, which showed mild contractions of -0.1%.

Labour market data showed the unemployment rate staying stable at 5.1%, in line with expectations. PMI data released in January showed a notable improvement in business activity. Manufacturing PMI moved firmly into expansion territory, while services activity strengthened further, pushing the composite PMI to its highest level since mid-2024.

The UK Construction PMI rose to 40.1 in December, up from the 5-year low of 39.4 in the previous month, but the reading indicates a full year of monthly declines. Uncertainty about the UK’s budget has significantly affected investment decisions in the sector, with civil engineering, housing, and construction all showing declines we haven't seen since COVID.

Construction PMI. Trading Economics, 2026

Looking at housing, there are continued signs of a softening market, with price appreciation slowing and mortgage approvals declining.

The Halifax House Price Index showed prices rose 0.3% year-on-year, slowing from 0.6% in November, missing the 1.1% expected and marking the smallest growth in over two years. The average house price fell by £1,789 to £297,755, the lowest level since June.

Halifax House Price Index YoY. Trading Economics, 2026

The RICS Residential Market Survey remains in negative territory, with London and the South East continuing to underperform, while Scotland and Northern Ireland are the strong performers. Once again, the survey respondents maintain a positive outlook for the future.

RICS House Price Balance. Trading Economics, 2026

Finally, net mortgage approvals for house purchases dropped in December and missed forecasts, hitting the lowest level since the summer of 2024. The temporary tax breaks on certain purchases and uncertainty on the tax budget were cited as the main reasons.

China

China’s macro data released in January leaned more bearish, with ongoing weakness in manufacturing and housing and easing industrial production and retail activity.

Official PMI data showed manufacturing slipping back into contraction territory in January (49.3), underscoring the fragility of the recovery. New orders and export demand remained weak, while employment indicators continued to deteriorate. Industrial production growth slowed further, marking one of the weakest prints in several years, reinforcing concerns around overcapacity and weak domestic demand. Retail sales also declined and missed the forecast.

On the positive side, inflation data showed modest improvement, with headline CPI remaining positive on a year-on-year basis, supported by food and energy prices, while GDP growth was on par with forecasts for 4.5% year-on-year.

China Industrial Production. Trading Economics, 2026

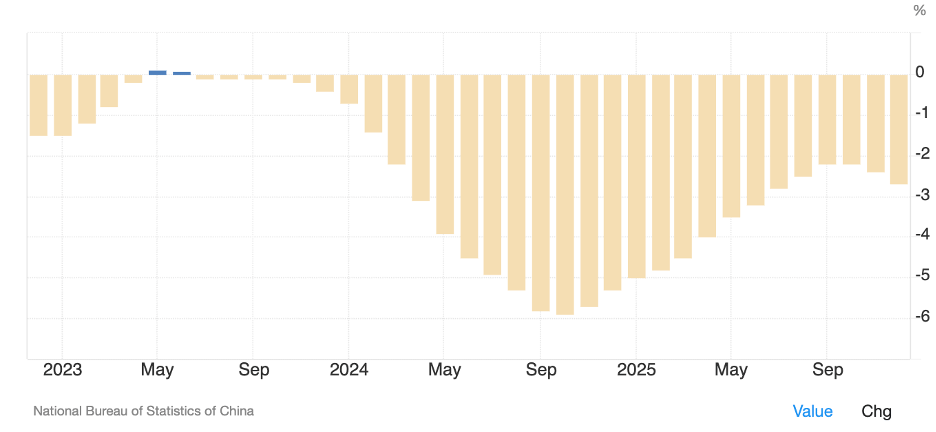

Housing data remains the key drag. Nationwide new home prices continued to fall on both a monthly and annual basis, extending the longest downturn on record. China’s new home prices declined 2.7% year-on-year in December 2025, marking the 30th consecutive month of price decreases and the fastest pace since July.

China Newly Built House Prices YoY Change. Trading Economics, 2026

References

(n.d.). US Treasuries Yield Curve. US Treasuries Yield Curve. https://www.ustreasuryyieldcurve.com/

(n.d.). CME FedWatch Tool. CME Group. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

(n.d.).Trading Economics. Trading Economics. https://tradingeconomics.com/united-states/nahb-housing-market-index

(n.d.).Goldman Sachs. Goldman Sachs. https://www.goldmansachs.com/

(n.d.).Bloomberg. Bloomberg. https://www.bloomberg.com

(n.d.). FRED. Federal Reserve Economic Data. https://fred.stlouisfed.org/

Disclaimer

Wizard of Soho LLC and Weekly Wizdom publish financial information based on research and opinion. We are not investment advisors, and we do not provide personalized, individualized, or tailored investment advice, nor do we provide legal advice or information. The publisher does not guarantee the accuracy of the information provided on this page. All statements and expressions presented are based on the author's or paid advertiser's opinion and research. Directly or indirectly, no opinion is an offer or solicitation to buy or sell the securities or financial instruments mentioned.

As news is ever-changing, the opinions included should not be taken as specific advice on the merits of any investment decision. Investors should conduct their own investigation and review of publicly available information to make decisions about the prospects of any company discussed. Any projections, market outlooks, or estimates herein are forward-looking and inherently unreliable. They are based on assumptions and should not be construed as indicative of actual events.

Contrarily, other events that were not considered may occur and significantly affect the returns or performance of the securities discussed herein. The information provided is based on matters as they exist on the date of preparation and does not consider future dates. As a result, the publisher undertakes no obligation to correct, update, or revise the material in this document or provide any additional information. The publisher, its affiliates, and clients may currently or foreseeably have long or short positions in the securities of the companies mentioned herein. They may therefore profit from fluctuations in the securities' trading price. There is, however, no guarantee that such persons will maintain these positions. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile, or any other means is illegal and punishable.

Neither the publisher nor its affiliates accepts any liability for any direct or consequential loss arising from any use of the information contained herein. By using the website or any affiliated social media account, you consent and agree to this disclaimer and our terms of use.