- Weekly Wizdom

- Posts

- Monthly Report: October 2025

Monthly Report: October 2025

United States

Macro-wise, the main event this month was the Federal Reserve’s continued rate cuts. Data-wise, we didn’t get much, as the government shutdown is delaying the release of key indicators, especially labour-market indicators.

The data we can use for the labour market has been the Preliminary data from ADP, which showed that the private sector added an average of 14250 jobs per week over the 4 weeks (ending October 11th), reversing the negative September print. Additionally, the Chicago FED estimates that September unemployment remains stable at 4.34%.

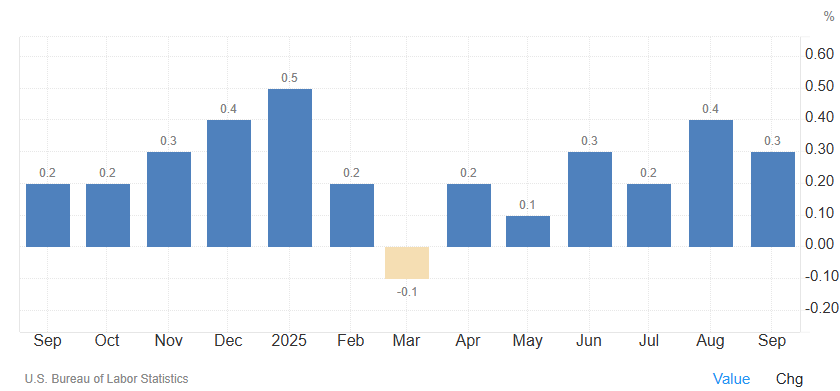

Both core and headline inflation cooled down on a month-on-month basis by 0.1%, compared to their previous figures. On a year-on-year basis, core inflation fell 0.1% to 3%, while headline inflation rose 0.1% to 3%; however, both were in line with market forecasts.

US Headline Inflation Month-on-month. Trading Economics, 2025

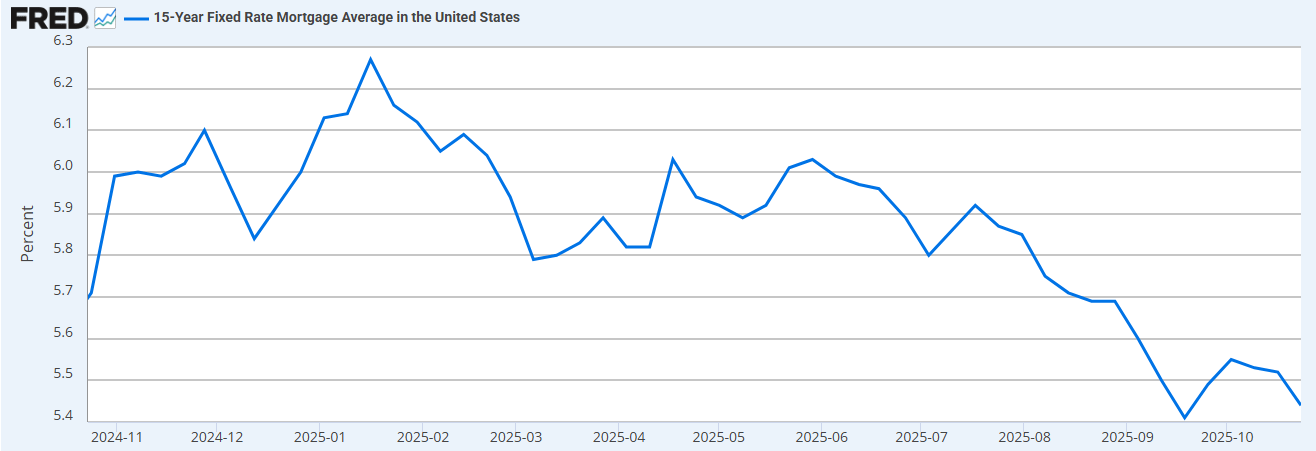

Mortgage rates continue their downward trend, reflecting the Fed's resumption of rate cuts. This marked the 4th consecutive month of declining rates. 30-year and 15-year rates collapsed by more than 15 bps and 10 bps, respectively, in October.

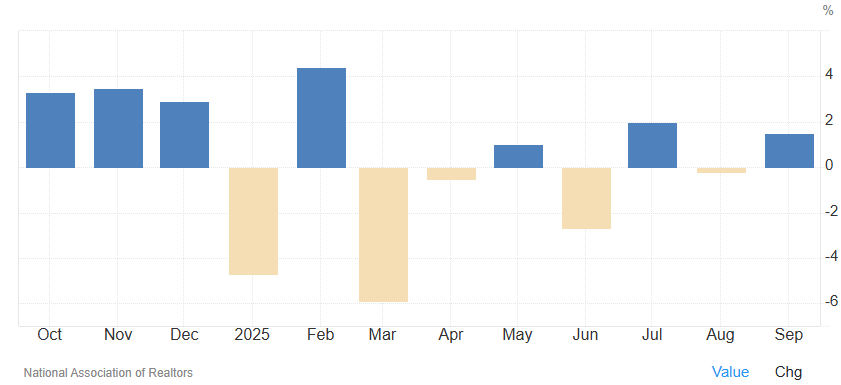

Existing home sales grew by 1.5% month-on-month to 4.06 million for September (up 4.1% year-on-year), marking the highest level in the last 7 months and a slight miss from the 4.1m expected. The median price for existing home sales is higher by 2.1% year-on-year and marks the 27th consecutive month of appreciation.

Existing Home Sales. Trading Economics, 2025

Existing Home Sales MoM. Trading Economics, 2025

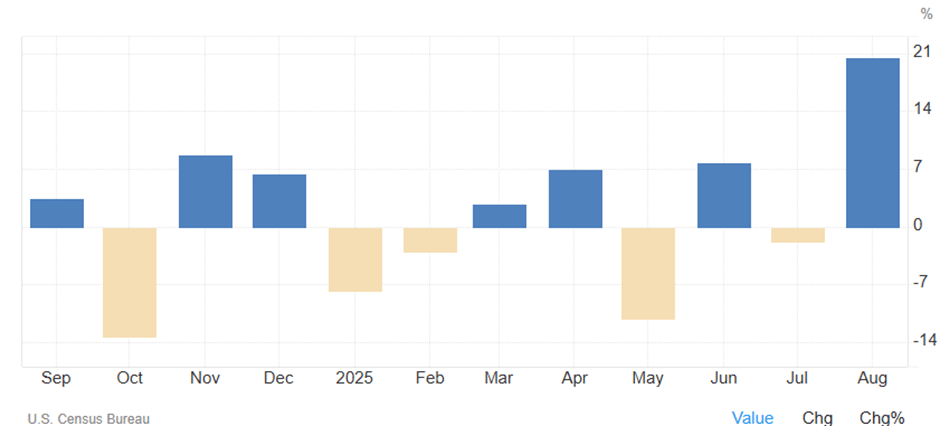

There isn’t any fresh data on new home sales, as a reminder, new home sales rallied by 20.5% from the previous month to an annualized rate of 800k, the highest level since 2021. Median prices for new homes also rallied by 4.7% month-on-month.

New Home Sales MoM (for last month). Trading Economics, 2025

United Kingdom

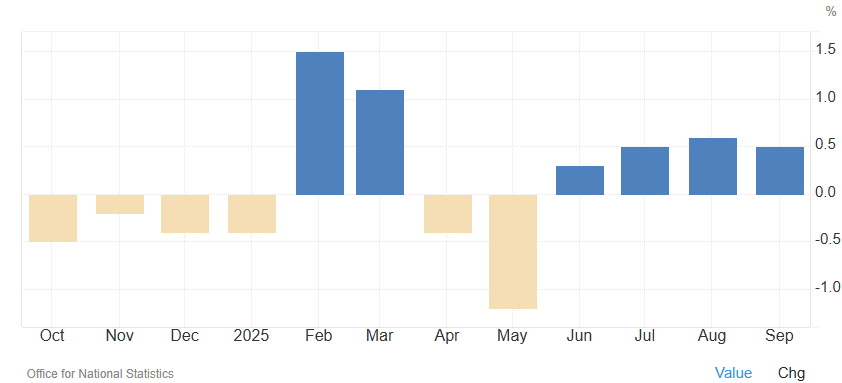

Overall, the data releases have been supportive in the UK this month, except for unemployment, which ticked up to 4.8% from the 4.7% expected and registered last month. Inflation remained stable at 3.8% year-on-year, beating expectations for a 4% print. GDP grew at 0.1% month-on-month vs. the -0.1% decline recorded last month. Retail sales outperformed, rising 0.5% month-on-month vs. the expected -0.1% decline. Manufacturing PMI rose to 49.6 from 46.2 previously and 46.7 forecast, while services PMI met expectations at 51.1m, up from 50.8 previously.

United Kingdom Manufacturing PMI. Trading Economics, 2025

UK Retail Sales Month-on-month. Trading Economics, 2025

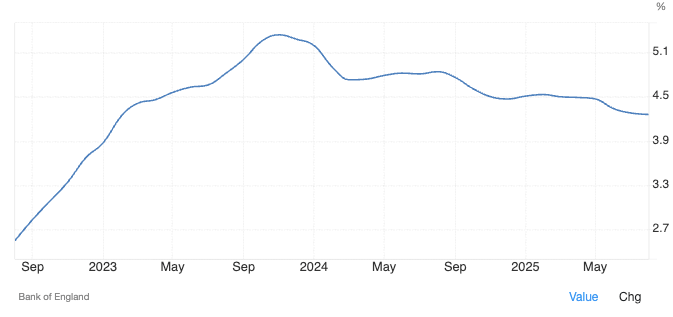

In a nutshell, the UK property market is stable, despite relatively high mortgage rates and all-time-high prices; however, consumer confidence seems a bit weaker than the indices suggest.

UK Interest Rate on New Mortgages. Trading Economics, 2025

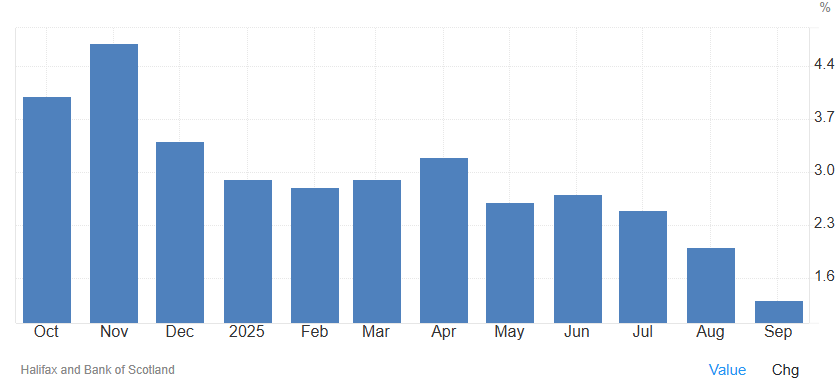

The Halifax House Price Index in the UK fell -0.3% month-on-month, reversing the latest gain and missing the 0.2% growth expectation. The Index still rose by 1.3% year-on-year, easing from the 2% increase last month and the 2.2% expectation. This marked the softest increase since April 2024 (since stamp duties went up). The average property value increased to £298,184, dropping slightly from last month’s record high.

Halifax House Price Index YoY. Trading Economics, 2025

Halifax House Price Index MoM. Trading Economics, 2025

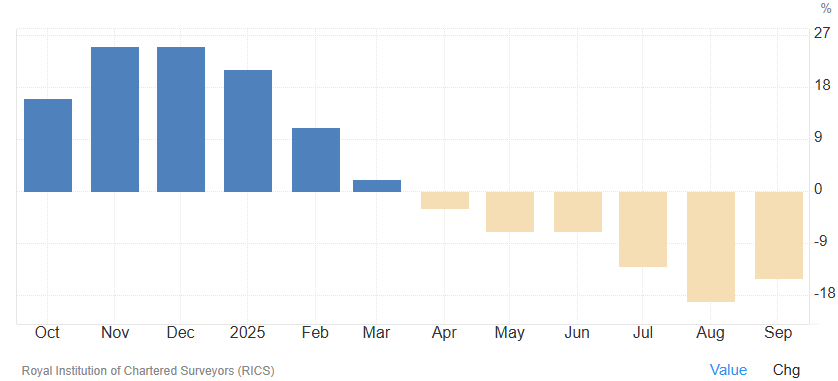

The RICS Market Survey showed the balance increasing to -15 in September, marking the first uptick following 5 consecutive negative readings and beating the forecast of -18. In the short term, the outlook remains slightly negative; however, most participants seem confident on a 12-month horizon.

RICS House Price Balance. Trading Economics, 2025

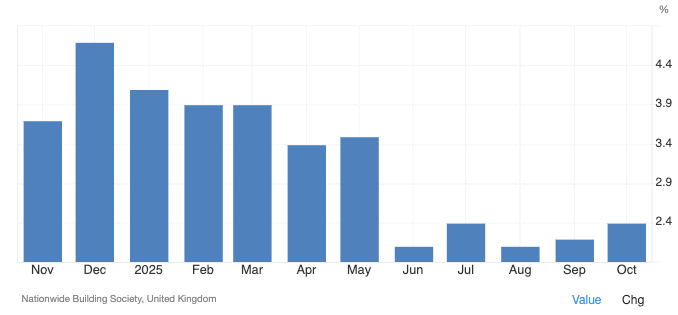

Finally, in the UK, the Nationwide House Price Index rose 0.3% month over month in October 2025, beating forecasts of 0% but easing from a 0.5% increase the previous month. On a year-on-year basis, the index rose by 2.4% beating the expected 2.3% and up from 2.2% in September.

Nationwide Housing Prices MoM. Trading Economics, 2025

Nationwide Housing Prices YoY. Trading Economics, 2025

China

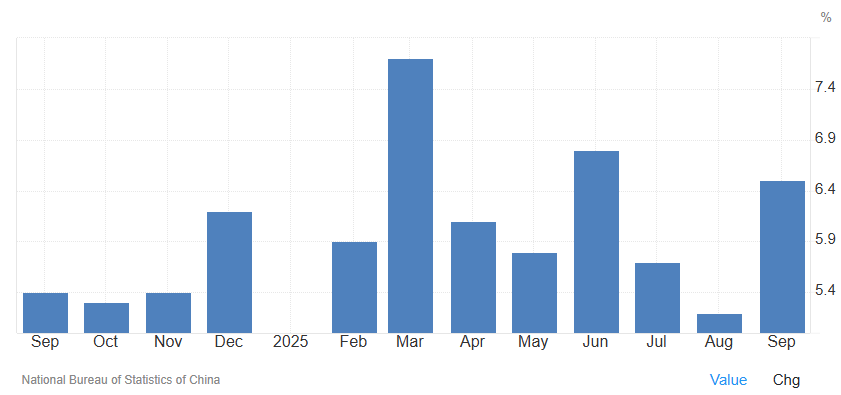

Once again, all the macro data from China remains inconclusive and mixed. Industrial production outperformed expectations, growing by 6.5% year-on-year, beating the 5.1% forecast. Retail sales printed at 3% year-on-year, a miss from last month's 3.4% but in line with expectations. Exports and imports showed higher growth year-on-year at 8.3% vs. 5.2% expected and 7.4% vs. 3.5% expected, respectively.

On the other hand, inflation came in at -0.3%, below the -0.2% forecast, and GDP grew by 4.8% year-on-year, below the 4.9% forecast and the 5.2% recorded last month.

China Industrial Production. Trading Economics, 2025

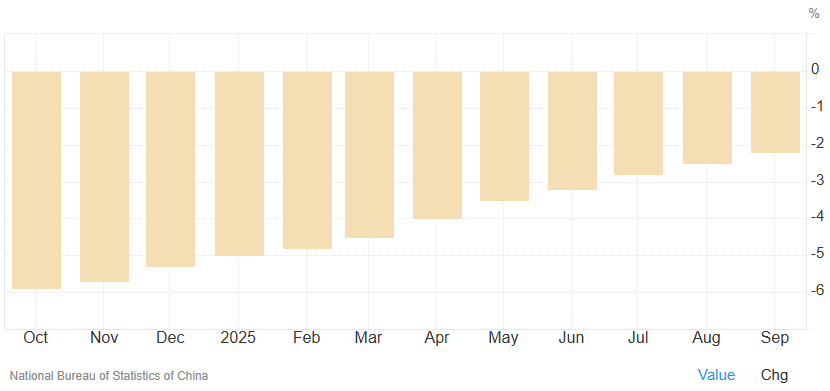

China’s new home prices were down by 2.2% year-on-year for September, continuing their trend for shallower yearly declines and the lowest decline since March 2024. Nonetheless, this now marks the 27th consecutive month of year-on-year declines in house prices and the biggest monthly drop (-0.4%) in the last 11 months. For the last 12 months, the year-on-year declines have been getting shallower, though. Shanghai is the main outlier, showing once again a 5.6% gain in house prices.

China Newly Built House Prices YoY Change. Trading Economics, 2025

WANT MORE?

We’ll make it easy for you! Upgrade to Premium and gain an edge in the markets with industry-leading insights and analysis.

References

(n.d.). US Treasuries Yield Curve. US Treasuries Yield Curve. https://www.ustreasuryyieldcurve.com/

(n.d.). CME FedWatch Tool. CME Group. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

(n.d.).Trading Economics. Trading Economics. https://tradingeconomics.com/united-states/nahb-housing-market-index

(n.d.).Goldman Sachs. Goldman Sachs. https://www.goldmansachs.com/

(n.d.).Bloomberg. Bloomberg. https://www.bloomberg.com

(n.d.). FRED. Federal Reserve Economic Data. https://fred.stlouisfed.org/

Disclaimer

Wizard of Soho LLC and Weekly Wizdom publish financial information based on research and opinion. We are not investment advisors, and we do not provide personalized, individualized, or tailored investment advice, nor do we provide legal advice or information. The publisher does not guarantee the accuracy of the information provided on this page. All statements and expressions present are based on the author's or paid advertiser's opinion and research. Directly or indirectly, no opinion is an offer or solicitation to buy or sell the securities or financial instruments mentioned.

As news is ever-changing, the opinions included should not be taken as specific advice on the merits of any investment decision. Investors should pursue their investigation and review of publicly available information to make decisions regarding the prospects of any company discussed. Any projections, market outlooks, or estimates herein are forward-looking and inherently unreliable. They are based on assumptions and should not be construed to be indicative of actual events that will occur.

Contrarily, other events that were not considered may occur and significantly affect the returns or performance of the securities discussed herein. The information provided is based on matters as they exist on the date of preparation and do not consider future dates. As a result, the publisher undertakes no obligation to correct, update, or revise the material in this document or provide any additional information. The publisher, its affiliates, and clients may currently or foreseeably have long or short positions in the securities of the companies mentioned herein. They may, therefore, profit from fluctuations in the trading price of the securities. There is, however, no guarantee that such persons will maintain these positions. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile, or any other means is illegal and punishable.

Neither the publisher nor its affiliates accept any liability for any direct or consequential loss arising from any use of the information contained herein. By using the website or any affiliated social media account, you consent and agree to this disclaimer and our terms of use.