- Weekly Wizdom

- Posts

- Silver in Uncharted Territory

Silver in Uncharted Territory

What next?

Silver has once again shown why it’s called the "Devil’s Metal," rising more than 125% in 2025 alone. While gold represents a steady asset and is considered a safe haven, silver is quite the opposite, with erratic, explosive moves and a unique mix of industrial and safe-haven demand. Today, I’ll give a quick overview of silver over the years, where it stands today, and what one could expect moving forward.

Here’s what we’ll cover:

Background on Silver

The Current Silver Rally

Supply and Demand Dynamics

The Gold-to-Silver Ratio (GSR)

Before we get started, here’s a quick chart to show how silver has performed this year compared to other asset classes as of December 19, 2025.

as on 19 Dec 2025

Historical Context

For millennia, silver served as the primary currency for the masses. While gold was reserved for kings and international settlements, silver was the metal of daily commerce, used for wages, trade, and taxes from Ancient Rome to the British Empire. Historically, it has always held a "dual identity": a monetary safe haven and a versatile industrial material. Even today, silver retains this dual role.

In the last 100 years, silver has seen three major rallies, including the most recent one in 2025:

1979: Driven by the Hunt Brothers' attempt to corner the market, silver prices skyrocketed from roughly $6 to $50 in a single year. The rally collapsed in March 1980 on "Silver Thursday" after regulators changed trading rules, forcing the price back down to $11 almost overnight.

2011: Following the 2008 financial crisis, massive quantitative easing (QE) and a weak dollar pushed investors back into hard assets, driving silver toward its all-time high of $49.80. However, the rally lacked industrial support and crashed once the U.S. dollar stabilized and exchange margin requirements were hiked.

2025: The current breakout.

The Current Rally of 2025

As of December 2025, silver has shattered its long-standing ceiling, trading near $66/oz. Unlike previous rallies, this move is not purely speculative; it is a "catch-up" play to gold, which hit records earlier in the year, fueled by a weakening dollar and geopolitical instability. While geopolitical uncertainty is a factor, it isn't the primary driver. More than 60% of silver demand is industrial, and with rising demand meeting restricted supply, prices have "popped off."

We are currently in the fifth consecutive year of a global silver supply deficit. Silver is a major component in electric vehicles (EVs), solar panels, and even AI data centers. Recently, nations worldwide have ramped up these three industries. Because silver is a sought-after commodity for these sectors, prices have skyrocketed.

While demand has been surging in the industrial, investment, and jewelry sectors, supply has not yet caught up. Most silver is a by-product of lead, zinc, and copper mining. Since miners aren't opening new "pure silver" mines quickly enough, supply remains stagnant despite exploding demand.

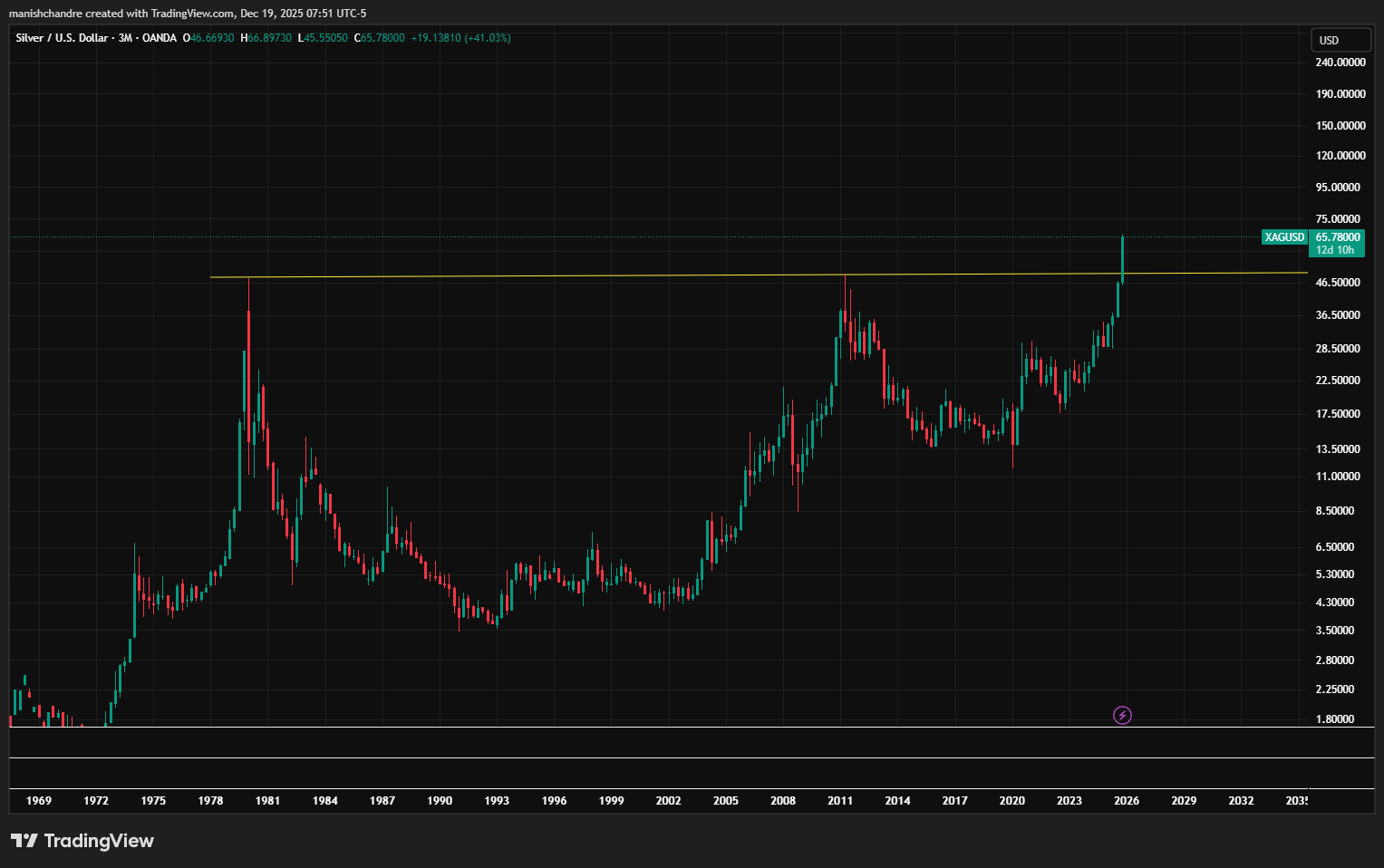

Silver in a 3-month timeframe

Currently, silver trades at approximately $65 per ounce, a significant move above its previous major highs of $50. While fund houses are speculating that targets around $70–$75 are likely, the metal’s peak is anyone's guess at this stage. One way to assess the rally's potential is by examining the Gold-to-Silver Ratio (GSR).

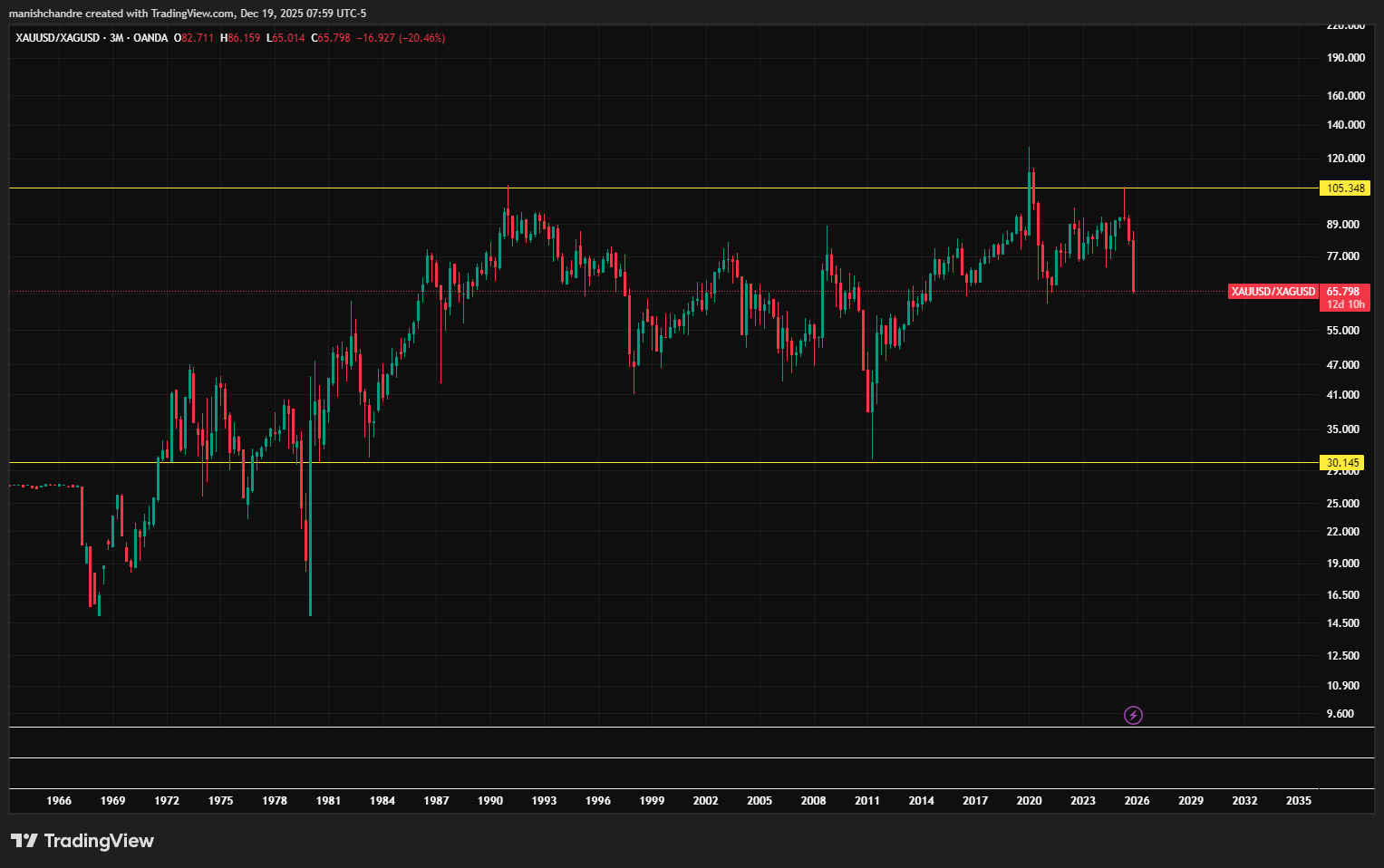

XAUUSD/XAGUSD in a 3-month timeframe

The chart above shows the gold-to-silver ratio, which indicates how many ounces of silver are required to purchase one ounce of gold. A higher ratio suggests silver is undervalued, while a lower ratio suggests it is overvalued.

In early 2025, the ratio peaked near 100 and has since fallen as silver outperformed gold in relative terms. Historically, this ratio averages around 60–65, excluding the two major drops in 1979 and 2011. Currently, we are hovering around the historical average of 65, so it is time to be cautious and watch for reversal signals in the short term.

Are we headed for the lower end of the ratio chart in the long term? Maybe!

Disclaimer

Wizard of Soho LLC and Weekly Wizdom publish financial information based on research and opinion. We are not investment advisors and do not provide personalized, individualized, or tailored investment advice. Additionally, we do not offer legal advice or information. The publisher does not guarantee the accuracy of the information provided on this page. All statements and expressions presented are based on the author's or paid advertiser's opinion and research. Directly or indirectly, no opinion is an offer or solicitation to buy or sell the securities or financial instruments mentioned.

As news is ever-changing, the opinions included should not be taken as specific advice on the merits of any investment decision. Investors should conduct their own investigation and review of publicly available information to make informed decisions regarding the prospects of any company discussed. Any projections, market outlooks, or estimates herein are forward-looking and inherently unreliable. They are based on assumptions and should not be construed as indicative of actual events.

Contrarily, other events that were not considered may occur and significantly affect the returns or performance of the securities discussed herein. The information provided is based on matters as they exist on the date of preparation and does not consider future dates. As a result, the publisher undertakes no obligation to correct, update, or revise the material in this document or provide any additional information. The publisher, its affiliates, and clients may currently or foreseeably have long or short positions in the securities of the companies mentioned herein. They may therefore profit from fluctuations in the securities' trading price. There is, however, no guarantee that such persons will maintain these positions. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile, or any other means is illegal and punishable.

Neither the publisher nor its affiliates accepts any liability for any direct or consequential loss arising from any use of the information contained herein. By using the website or any affiliated social media account, you consent and agree to this disclaimer and our terms of use.