- Weekly Wizdom

- Posts

- The 2026 Macro Environment

The 2026 Macro Environment

Written by: Pidgeon

In this report, we’ll go through the major macro factors affecting crypto and the wider financial markets. We’ll run through bull and bear scenarios and how we should position ourselves based on our analysis.

If I had to sum up the 2026 macro situation in 1 word, it would be ‘Uncertainty.’

Between escalating global tensions and an AI revolution, there are a lot of questions about the future, but let’s break down what we do know piece by piece.

Artificial intelligence

AI is a contentious topic, but regardless of your opinion on the slop machines, they’re not going anywhere. So let’s see what the outlook is for 2026.

Institutional Bulls

According to research by major banks & financial institutions, companies in logistics, insurance, and other sectors are seeing significant cost reductions driven by AI-driven efficiency gains.

Due to these cost reductions, banks & institutions are pricing in 12-15% earnings growth for non-MAG7 companies in the S&P 500.

In other words, they believe that AI efficiency improvements should lead to better earnings and, in turn, higher prices.

Dark Clouds

We can’t talk about AI without talking about bubbles.

AI has drawn unprecedented levels of investment, far exceeding even the Dotcom bubble. In 2026, investment and spending are expected to increase even more.

While companies like NVIDIA and Microsoft have seen immense revenue from the AI boom, the industry is becoming a bit incestuous.

When AI companies receive VC funding, they use the money to build data centers with Oracle or another provider. They then turn around and give that money to NVIDIA for the chips to build a data center.

Then the companies that just got paid by the AI companies turn around and invest more money in those same AI companies, which then give it back.

Because these companies are “making” so much money or receiving so much “investment,” their valuations go up more than they probably should.

This is also reflected in the S&P 500 valuation relative to M2 money supply growth.

Usually, the S&P 500 trades choppily sideways when accounting for M2 supply growth, but now it’s massively outperforming.

The last time that happened was in the dotcom bubble.

S&P 500 / USM2 chart on TradingView

All of this is fine under one condition: AI does what the industry promises it will, and it does so quickly enough.

AI is incredible technology, but the sheer amount of investment made into it requires it to be much, much better, and much, much more profitable than it is right now. If AGI or ASI doesn’t release, and AI agents remain mediocre in 2026/2027, then that paints a grim picture for the AI industry and broader markets.

But therein also lies an important caveat. AI can keep kicking the can down the road.

I will wholeheartedly state that this is, in fact, a bubble, but that bubble will likely keep growing.

I think AI will continue to grow in 2026. The tech gets better, and with that, company costs go down, and earnings go up. From an AI perspective, the stock market should continue higher. Crypto sees limited benefit from AI and, as such, will likely not be impacted too much.

In 2027-2028, we will see whether the AI bubble pops, crashing both stock and crypto markets into Hades. Or if it delivers on its promises and acts as a new industrial revolution for the internet era, sending everything up.

K-Shaped Economy

Since COVID, the Western world's economy has been under strain. People are using buy now, pay later (debt) to buy their next burrito. They couldn’t dream of buying a house. Job numbers are inflated by gig work, keeping unemployment low.

Yet at the same time, we’re not in a traditional recession. This is because there’s a small group of people, the top 20%, who hold assets and own homes (me lmao). As prices rose, the value of stocks and assets rose in tandem.

Pair that with higher pay, and overall, the top 10% are doing pretty great. So great in fact that they were responsible for nearly 50% of all U.S. Consumer spending last year.

In 2025, spending in this group also stagnated; however, the wealth effect is drying up a bit.

We’ll likely see the economy worsen before it gets better. A small crack in AI valuations could bring down the stock market and with it the top 20%.

Once they’re out, we’d enter full recession mode.

For the time being, I believe that the K-Shaped economy rides in tandem with the AI bubble. It will likely keep going for a while as the top 20% will continue to make money as long as the markets are snorting AI-fairy dust.

If it ends, we’ll likely see drawdowns across risk assets.

Unicorn Season

2026 is set to be the year of many Unicorn IPOs. These are companies with valuations over $1B. IPOs are a bit of a double-edged sword, as they provide liquidity for investors who have been locked out for years and now have great profits to spend.

But at the same time, as these companies go public, the market needs to absorb their shares.

I believe that in a continued bull market with ample liquidity, this should not be an issue and would likely push many stocks higher.

But if markets are weak, this can further exacerbate liquidity shortages and lead to additional drawdowns. Though all in all, this is a relatively minor event.

A Corrupt Fed

2026 is also the year of a scary change in the US, as the positions of Federal Reserve Chair and Board members open up.

Trump has shown, time and time again, his desire for a Federal Reserve (Fed) that does what he wants, rather than what the Fed believes is best for the economy. Recently even fabricated a criminal lawsuit against the current Fed chair to get him to comply.

Long story short: the Fed manages interest rates to keep inflation and unemployment under control. Low interest rates can drive strong economic growth, but often lead to runaway inflation.

It’s a general rule of being a sovereign leader that you don’t fuck with your central bankers.

Examples of those who ignored that were Erdoğan of Turkey and Maduro of Venezuela. Both these countries have experienced hyperinflation following their decision to set interest rates themselves.

If Trump elects a central banker who does what he wants in the short term rather than what’s best for the economy in the long term, we’ll run into some major issues.

A corrupt Fed will keep interest rates artificially low to boost the economy during Trump’s term, but in the years that follow, inflation will come back to haunt the US people and the dollar.

If Trump elects a new Fed chair and Fed board who follow what the president wants, rather than what’s best for the economy, here’s what I think will happen.

Risk markets may crash initially as they are spooked by a less stable, less trustworthy US.

Following this, we could very well see an inflation-fueled “supercycle”.

Rather than assets' values rising, they simply rise in paper value as the dollar loses buying power.

This would likely spill over into crypto, as well. The US accounts for a large share of the market, and even paper gains can create a wealth effect that could rotate more and more into risk assets.

Trade & War

Trade War & Debt

In 2025, we saw a heated trade war between the US and much of the world. While things cooled down near the end of the year, tariffs remain in place, and the trade war is not over just yet.

With the recent Greenland situation, things seem to be heating up again, as Trump threatened to put new tariffs on many EU countries, even though a trade deal was already reached with the EU. This hinders economic growth and further pressures asset prices.

Anything that puts extra pressure on the system can greatly increase the risk, given the current US situation of record-high consumer and public debt, as well as private credit leverage.

This also strains relations among Western nations, pushing us toward a more fragmented global economy or even a new system of middle powers where the US gets cut out and loses sway.

All this lowers the US's economic prosperity and reduces outside investors’ willingness to purchase US assets. To keep the markets rising and the system intact, it’ll require ever-increasing stimulus to achieve the same result.

The Black Swan

While things seem alright for now, geopolitical tensions continue to rise. But the fact remains that the world is arming itself again, and with the potential for an invasion of Taiwan in 2027-2028, the risk of World War III doesn't seem so far-fetched.

Historically speaking, war is only bad for markets if it happens on your country’s soil. Uncertainty leading up to war may cause some minor drawdown, but the actual war itself tends to, weirdly enough, be quite positive for markets.

Liquidity becomes reliable and predictable, so markets feel relatively stable and comfortable.

In the case of a war between the US and China, however, a major flash crash would seem likely. A vast chunk of the US market valuation comes from businesses that rely on China for their products.

While Trump has attempted to bring manufacturing back to the US from China. China is still responsible for 90% of global rare-earth refining. Rare earth minerals are not actually rare at all; everyone has them, but only China currently has the capability to refine them in large quantities.

These minerals are needed for all your electronics, so a war between the two nations would cause chaos in the short term.

But rather than potential wars 1-2 years from now, let’s see where the money is flowing now.

Liquidity Injections

This year, we’ll also see a few major injections of liquidity into the economy and markets.

Big Beautiful Bill

The One Big Beautiful Bill is set to bring over $100 billion in tax refunds and reductions to US consumers.

This puts more money in the hands of everyday people, including those who went hog wild in 2021.

While, in theory, more money in their pockets would be good for risk assets, I would say that the K-shaped economy offsets this.

Wealthier individuals may invest a bit more due to their rebate, but those at the bottom of the K, such as those who benefit from no tax on tips, don’t have enough excess capital to invest.

It’s likely that much of these tax rebates will flow into day-to-day costs, rather than risk assets.

Collateral Catch Up

Banks & Institutions are major holders of treasuries. They also like to borrow money against the value of these treasuries. Because bonds are such a stable asset, they make for great collateral, allowing these institutions to make optimal use of their capital.

Until recently, however, bond volatility was high. And as a result, lenders would not lend them nearly as much money.

In early 2026, however, this seems to be changing. As bond volatility has come down, lenders are willing to take a smaller haircut and lend more, giving these banks & institutions many billions of dollars in extra liquidity.

People’s Bank of China

Currently, the Chinese central bank is printing furiously. Rather than inflation, they’re facing deflation. To fight this off, they are trying to put more and more money into the system and ease economic conditions to get people spending more.

All that excess liquidity in China can spill over into Western markets through Western banks in Asia and through institutions in Hong Kong. Get yourself cheap money in Asia, use it as your backbone while you buy assets in the US and EU.

Increases in Chinese liquidity have often led to price increases in cryptocurrencies.

Stablecoin Regulation

2025 was the year of the stablecoins, and no, I’m not talking about Bitcoin.

Throughout the year, we saw dozens of different stablecoin protocols launched, many of which were backed by traditional financial institutions.

Hold our stablecoin and get yield from treasuries. Hold ours and get yield from Minerals and Gas. Hold ours for access to Private Equity or Repayment Financing.

Traditional instruments were coming on-chain. And now, with recent US regulations, stablecoin providers like Circle (USDC) are federally regulated, giving many big players the confidence to use and build with them.

While it does not directly affect liquidity, it enables more money to come on-chain, indirectly boosting crypto liquidity.

Strategic Bitcoin Reserve

The Trump administration has been very friendly to the crypto industry. Early in his administration, there was a lot of talk about creating a Strategic Bitcoin Reserve. Currently, they have stopped selling, but Senator Cynthia Lummis continues to push for a more aggressive approach.

To buy 1 million Bitcoin over 5 years. While they are not actively buying yet, some speculate that 2026 could be the year they start accumulating.

The US government would effectively work like a second Saylor, but without the leverage and risk.

This would result in them buying ~7.3% of all Bitcoin available on exchanges, each year.

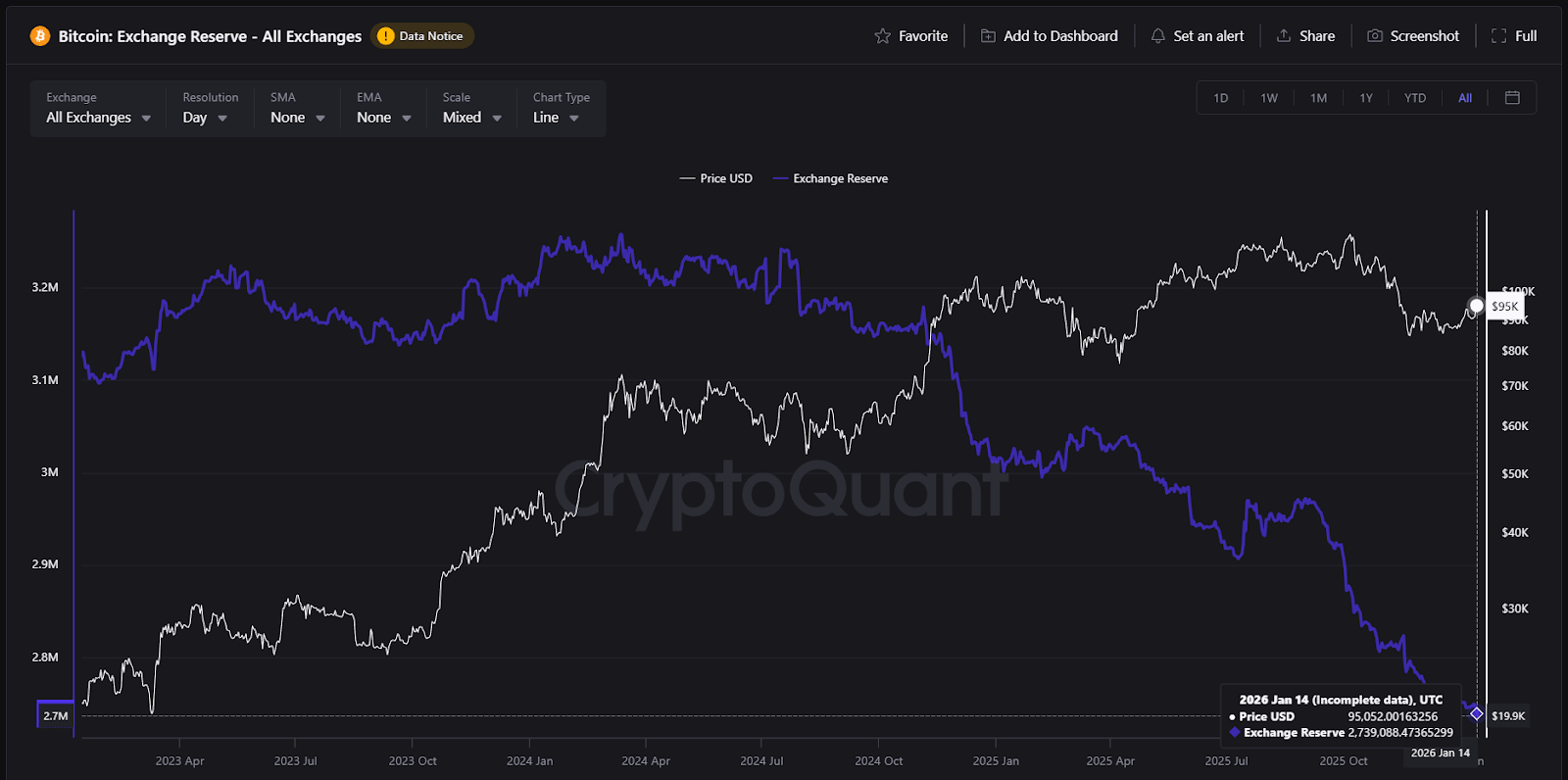

Total All Exchange Reserves for Bitcoin. CryptoQuant, 2026

That would be a substantial boost to Bitcoin liquidity and have a positive impact on price.

This would not prevent a bear market on its own, but it would likely reduce Bitcoin's drawdown. It would, by the same logic, improve price appreciation in a bull market.

As a side note, Bitcoin exchange reserves are at their lowest level since late 2018. This should meaningfully increase volatility. Less money is required to move prices up or down, though a good part of this will be absorbed by perps and market makers, so don’t expect anything too crazy.

The Liquidity Black Hole

$350 trillion. That’s how much debt there is in the world, according to the Institute of International Finance (IIF). That’s double what it was in 2008, and quadruple what it was in 2000. The world is addicted to debt.

But the thing is, no one actually pays back their debts; they simply refinance. That means they take out a new loan to pay off the old one.

This new loan comes with new rates, and therein lies a big issue. During 2020-2021, interest rates around the world were between 0-2%, and a massive number of 5-year loans were taken out by companies, institutions, and even governments; now, $40 trillion worth of these loans are set to refinance in 2026.

Interest rates are at 4-5% now, and many companies that got overextended simply can’t afford to refinance at those rates. So they’d have to pay it back.

They have a few different options:

Asset Sales: An institution may sell its assets and dump them on the market to repay its loans.

Default: Others who don’t have the assets may default and declare bankruptcy.

Slow Drain: Those who can afford to refinance might do so, but they’ll be stuck with 3-8x higher interest payments, forcing them to spend money servicing their loans rather than on growth.

Much of this is limited to poor credit companies and the commercial real estate sector. But many others still experience the slow drain, as they got an extension on their loans. “We’ll let you pay us back in 2028-2030, but your interest rate will be higher.”

This debt is unlikely to cause a crash in itself; the players who will go bankrupt or sell their assets are few. But the wider cost of the interest rates will continue to drain liquidity from the system.

The Central Bank’s Plan

In the last few months, most major central banks have been printing money, but this hasn’t resulted in the price pumps we’ve seen in the past.

This printing isn’t stimulus, it’s more like maintenance cash. It’s being sucked into a black hole of government debt and corporate interest payments before it ever hits financial markets.

The central bank is trying to keep the banks from panicking. By flooding the Repo Markets with cash, they provide a "safety net" that encourages banks to keep lending. It’s a psychological game: as long as banks know the central bank will provide infinite liquidity for their collateral, they’ll feel comfortable rolling over those 2026 loans.

4-year Cycles

Historically, Bitcoin and crypto as a whole have observed 4-year cycles. Also known as the Halving Cycles.

Every 4 years, Bitcoin’s supply halves, increasing mining costs and reducing the number of coins entering the market.

Chart Plotting out the 4-year Cycles

When looking at these cycles, we’ll see a macro top is usually followed by a roughly 1-year bear market, with the low coming about 1.5 years before the halving. When looking at these cycles, we’ll see a macro top is usually followed by a roughly 1-year bear market, with the low coming about 1.5 years before the halving.

At the halving, there’s usually a 6-month consolidation phase before the final leg up of the bull market, which tops out 35 months after the bear market low was made.

While this is far from the most scientific approach, many traders have said throughout this cycle that it won't happen this time.

The fact remains that this cycle has followed exactly the same structure as the 4-year cycle would suggest. The only remaining part to see now would be the 1-year bear market. If the top remains at $126K in October 2025, then we’d expect to see the bear market bottom in October 2026.

And the last thing to remember is that the four most dangerous words in markets are “This time is different.”

Technicals

The last piece of our puzzle is in the charts.

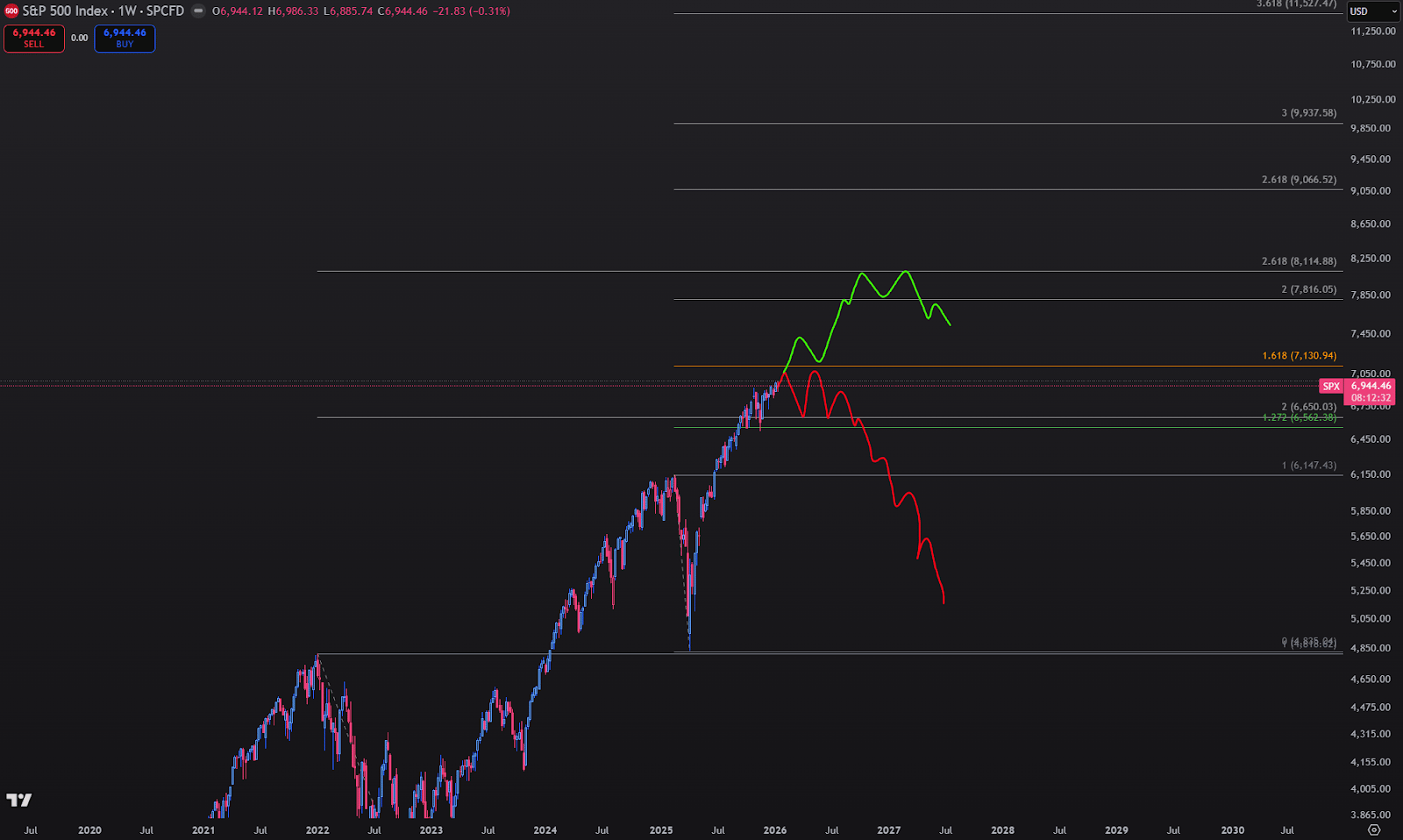

S&P 500

For the S&P 500, the chart remains up and to the right. While it’s just about due for a pullback, it’s not a macro topping construction, like we saw in 2000 or 2007

With it flipping relevant Fib levels recently, we could actually see the S&P 500 just slowly grinding higher. Currently, the chart shows us a macro target of around $7.8K to $8.1K. If that’s hit without a major retracement first, that would be a good point for an exit, as it would be way overextended.

If instead we see a healthy uptrend with pullbacks along the way, perhaps there’s hope for growth beyond that.

Bear Case

While there’s no topping construction now, if the S&P starts forming one, things become very iffy, very quickly. For a topping construction, we’d look at repeated pull-backs in the same area, where the pump price barely breaks through the previous high before dipping again.

That would make for a distribution range, showing signs of major off-loading across the market.

Due to the lack of consolidation in this uptrend, there is little to no support. This means once we start heading down, we can head down quickly. Similar to March ‘25, when pricing nuked down in a relatively short period.

Bitcoin

Base Bear Case

The BTC chart has us pretty bearish. Right as the 4-year cycle should top, Bitcoin did. It swept liquidity at the highs after 10 months of slow distribution. It then broke the base support we’d held throughout the entire bull market and formed a lower low.

This effectively means we are bearish on Bitcoin until proven otherwise. We could see Bitcoin bounce a bit higher, towards $106K, before trading back down towards $70K. Once that starts breaking and price pushes down below $65K, things should go pretty fast towards $45K and perhaps even $30K.

Crab Case

While we’re betting on a bear market right now, there are other options we should consider.

A Crab market is simply one that only goes sideways. For this, there are two main scenarios we could look at.

The Boring Winter: Bitcoin follows our initial bearish thesis. It trades a bit higher, then moves down to the $70K support area. It then holds this support before ranging between $70K and $100K.

Then, in late 2026/Early 2027, the market decides its next move.Breaking the Cycle: A decently likely option is a mix between the idea of the ‘Supercycle’ and a crab market. It invalidates the 4-year cycle, not by continuing a golden bull run, but by slow, grinding sideways and up.

It would make slightly higher highs before trading back down. Then, once an outside trigger comes along, the market breaks out. Either into a massive winter cause of financial turmoil (AI bubble collapse), or into a massive bull run due to unnatural liquidity injections and inflation.

Bull Case

While unlikely, a continued bull market is technically possible. We’d see this come from a strong move up, breaking out above $130K and flipping the previous all-time high into support. This would likely signal a continuation towards $170K, and, depending on the juice behind this run, perhaps even $300K.

Scenarios

We’ve gone through over a dozen topics, each of which influences markets in its own way. Now, let’s synthesize all that down into a few main scenarios.

The Golden Bull Run

This scenario is one of economic prosperity and sky-high asset prices.

Bitcoin: $300,000

S&P 500: $9,000

It relies on the following to happen

AI either becomes significantly better, significantly improving corporate efficiency, resulting in higher earnings and lower costs. It results in greater confidence in the AI sector and fewer fears of a bubble popping.

As economic conditions improve, people receive their rebates, are under less financial pressure, and the various liquidity injections provide enough liquidity for things to stabilize. The refinance wall is successfully pushed back or rolled over.

Trump takes control of the Fed, uses it to lower rates and start QE, and now it’s being used directly as stimulus. They do it within reason enough that the market isn’t scared of a corrupt Fed.

The US starts buying 200,000 Bitcoin for the Strategic Reserve.

Unicorn companies IPO at silly valuations only to rip them higher anyway. Crypto rips and the 4-year cycle is broken.

In late 2027, things calmed down again as things re-adjusted back to normal levels.

A Visit to Hades

This scenario is one of economic implosion.

Bitcoin: $30,000

S&P 500: <$3,600

It might play out something like this:

AI continues to drain money from the system, yet shows no good results. Investment dries up, and companies that benefited from the AI boom dump in value as their earnings vanish.

Trade wars resurface, and the chance for a real war increases. Markets feel uncertain.

Even with central bank support, banks are unable to properly handle the $40 trillion in debt, leading to small-company bankruptcies and further draining already strained liquidity.

Trump attempts to take control of the Fed, but it only breeds a lack of confidence in US markets, and global investors pull out. Unicorns IPO but flop, dumping overvalued companies on already weak investors. Paired with the price drops in big tech, the market panics further.

Markets bounce back in 2028, but recovery is slow as the debt still eats away at liquidity.

The Caffeinated Bull

The Bull is tired but keeps trying for another year anyway.

Bitcoin: $100,000 - $170,000

S&P 500: $6,500 - $7,800

AI investment remains hopeful, but no world-altering progress is made in 2026.

Rates come down, people receive their rebates, economic conditions ease, and Trump's new Fed stimulates the markets and pushes prices higher.

But the weight of trade wars, the K-shaped economy, and the $40 trillion in refinancing largely offset the benefits.

Prices continue to grind higher, and Unicorns' IPOs spark some excitement that quickly peters out.

The crypto markets trade largely sideways due to a lack of risk appetite.

The Swamp

The wider world economy continues to pile on debt, and interest payments eat into growth. Global tensions continue to rise. The future feels uncertain.

Bitcoin: $30,000 - $70,000

S&P 500: $5,700 - $6,100

AI investment continues to drain money but has little to show for it. Large tech companies eat AI losses using their cash reserves.

The new Fed continues to lower rates slowly as the economy experiences some stagflation.

Meanwhile, the top 20% of the K-shaped economy slows their spending. The tax rebates help people, but are simply used to pay the bills.

Trade wars continue to slog on, hampering trade. The $40 trillion is extended quietly, but companies are paying 3-8x more for their loans, limiting their ability to spend on growth.

Unicorns decide to stay private; those who launch see mixed results.

The 4-year crypto cycle plays out as normal.

To me, ‘The Swamp’ or ‘Caffeinated Bull’ scenarios are the most likely. We could even see 2026 as the ‘Caffeinated Bull’, before reaching the ‘Swamp’ in 2027.

Regardless, I like to be prepared for any scenario.

Hope you don’t wanna kill yourself after reading all that.

Have a lovely day, and let’s make some money in 2026, regardless of what happens.