- Weekly Wizdom

- Posts

- Crash or Opportunity?

Crash or Opportunity?

Issue #155

Good morning!

Risk assets continue to struggle, despite robust earnings and stable macro data. Nvidia reported record revenue that beat expectations and forecast a healthy Q4 outlook; however, AI bubble concerns persist. Crypto experienced another liquidation event, further underscoring its very high beta to stocks.

FOMC minutes showed a divergence among participants regarding another rate cut at the December meeting in two weeks. Data-wise, we got mixed labour signals from the US with non-farm payrolls beating expectations (119k vs. 50k) while unemployment ticked up by 0.1% to 4.4%. The bond market has moved to pricing a rate cut with more than 65% likelihood, up from less than 50% last week, as Powell’s latest statement on considering a pause hasn’t been unanimous, with the NY Fed leaning towards a rate cut.

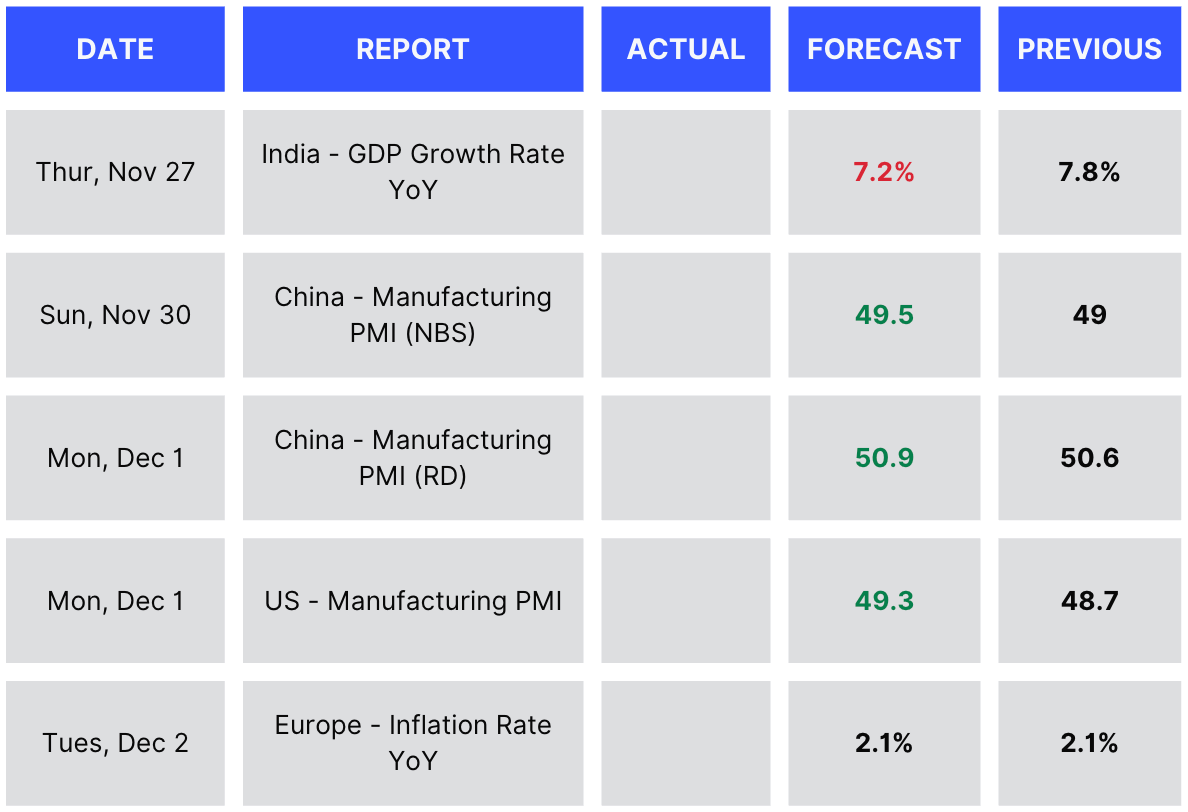

Looking ahead, we expect Core PCE and spending/income data from the US to be in line with previous prints. Tomorrow, India’s GDP is expected to show year-on-year growth of 7.2%, softer than the latest 7.8% print. Manufacturing PMIs for both China and the US are expected to improve; however, they remain far from any significant growth, as tariffs continue to dampen sentiment in the sector. Finally, next week, Europe’s year-on-year inflation is expected to remain stable at 2.1%, in line with the ECB’s target.

Trade Ideas This Week

We cover the following tickers:

Crypto: BTC, FIL, ZEC, SOL, ASTER, and ETH/BTC

Equities: LRCX, OPEN, RUM, MSTR, NXE, LAR, and WYFI

Remember:

✅ Read the trading plans carefully

🔔 Set price alerts

🎯 Time your entries

Enjoy!

Table of Contents

📊 Crypto

🔹 Foxy

📉 BTC

– NL short entry at 91,566.4 hit the main target at 86,327 and extended as low as 80,600.

📊 Move: –12% unleveraged

🧠 Textbook continuation selloff with clean target hits and deep extension.

📉 ZEC

– NL short entry at 565.3 dropped to a local low of 481.24.

📊 Move: –15% unleveraged

🧠 Strong downside follow-through as sellers maintained full control.

📉 FIL

– NL short entry at 1.912 hit the main target at 1.724 and capitulated further to 1.544.

📊 Move: –19% unleveraged

🧠 One of the cleanest breakdowns of the week, delivering multiple levels of profit.

🔹 Daniel

📈 ASTER

– Long from 1.107 in money glitch chat, smashed all TPs 1.16 and 1.20

📊 Move: –8.5% unleveraged

📈 BTC

– Long 82k main target of 89k hit

📊 Move: –8% unleveraged

📊 Equities

🔹 Donny

📈 IPX

– Rebounded strongly off the $26–28 buy zone highlighted in last week’s NL and is now trading back above $30.

🎯 Target: $55

🧠 Solid continuation setup and a strong candidate for both tactical long exposure and core holding expansion.

📈 NXE

– Bounced cleanly off the $7.40 zone identified in last week’s NL and is now trading around $8.

🧠 Respecting key levels and maintaining strong sector momentum.

📈 AFRM

– Rejected the $60 buy level perfectly and is now trading around $67, securing a ~12% spot gain in under one week.

🧠 Strong follow-through as buyers defended a major support area.

JUPITER x WEEKLY WIZDOM PARTNERSHIP

Jupiter has rapidly become Solana's dominant liquidity infrastructure, processing over $1 trillion in lifetime volume and commanding more than 90% of aggregator market share on the network. Jupiter has the fastest shipping team and offers the highest-quality products, along with the most misunderstood token. Whether you’re swapping tokens, trading perpetuals, creating your own memecoin, or launching a full-scale prediction market, Jupiter is building out the full suite of essentials needed for any DeFi strategy. At the heart of this approach is a user-centric philosophy: Jupiter looks to deliver real utility, discovery, and multi-product flexibility.

Beyond basic swaps, Jupiter gives you what the big players use: perpetual contracts with up to 250x leverage, limit orders, and dollar-cost averaging tools for entries you actually want to make, JupSOL liquid staking that gives you MEV rewards, and the LFG Launchpad to get into emerging Solana projects early. What really makes Jupiter different is their commitment to building across the entire stack. Jupiter blends best-in-class swap execution with next-gen features like:

JupSOL (liquid staking with MEV redistribution),

Jupiter Studio for frictionless token creation and management,

and the upcoming JupNet.

This aims to connect all blockchains so that assets and identities flow freely. Instead of forcing users to juggle endless wallets and dApps, Jupiter’s ecosystem makes advanced trading, launchpads, lending, and new asset types as accessible as sending a token. The team’s culture revolves around constant shipping, open communication, and rapid feedback from both retail and governance users. For Weekly Wizdom, partnering with Jupiter means bringing a unified, flexible DeFi experience to every member, no matter how or what they trade. It’s the foundation for discovering, launching, and compounding alpha across the Solana universe and beyond.

Jupiter is proud to announce its flagship community event called CatLumpurr 2026. This is set to kick off a new era for the ecosystem in Kuala Lumpur, Malaysia, on January 31 and February 1, 2026. This summit brings together traders, developers, and community leaders from the Solana DeFi space, offering a space for major announcements, energetic gatherings, and networking that sets the tone for the next year in Solana DeFi. For regulars in Weekly Wizdom channels, attending CatLumpurr means connecting with the people driving real liquidity and innovation. This translates to finding the right pools, improving trader tools, or refining tokenomics for the next meme coin cycle. The event demonstrates Jupiter's unique value proposition: direct access to leadership, transparent product updates, and a community-first approach to rapid evolution in a competitive DeFi market.

Jupiter represents the kind of product that sharpens us, and this partnership brings our community directly into the ecosystem where Solana's top traders operate. Don’t forget to stay in touch with Jupiter’s socials for the latest product developments and enhancements: x.com/JupiterExchange

Disclaimer

Wizard of Soho LLC and Weekly Wizdom publish financial information based on research and opinion. We are not investment advisors and do not provide personalized, individualized, or tailored investment advice. Additionally, we do not offer legal advice or information. The publisher does not guarantee the accuracy of the information provided on this page. All statements and expressions presented are based on the author's or paid advertiser's opinion and research. Directly or indirectly, no opinion is an offer or solicitation to buy or sell the securities or financial instruments mentioned.

As news is ever-changing, the opinions included should not be taken as specific advice on the merits of any investment decision. Investors should conduct their own investigation and review of publicly available information to make informed decisions regarding the prospects of any company discussed. Any projections, market outlooks, or estimates herein are forward-looking and inherently unreliable. They are based on assumptions and should not be construed as indicative of actual events.

Contrarily, other events that were not considered may occur and significantly affect the returns or performance of the securities discussed herein. The information provided is based on matters as they exist on the date of preparation and does not consider future dates. As a result, the publisher undertakes no obligation to correct, update, or revise the material in this document or provide any additional information. The publisher, its affiliates, and clients may currently or foreseeably have long or short positions in the securities of the companies mentioned herein. They may, therefore, profit from fluctuations in the trading price of the securities. There is, however, no guarantee that such persons will maintain these positions. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile, or any other means is illegal and punishable.

Neither the publisher nor its affiliates accepts any liability for any direct or consequential loss arising from any use of the information contained herein. By using the website or any affiliated social media account, you consent and agree to this disclaimer and our terms of use.