- Weekly Wizdom

- Posts

- Oil: Done. What Next?

Oil: Done. What Next?

Issue #160

Good morning!

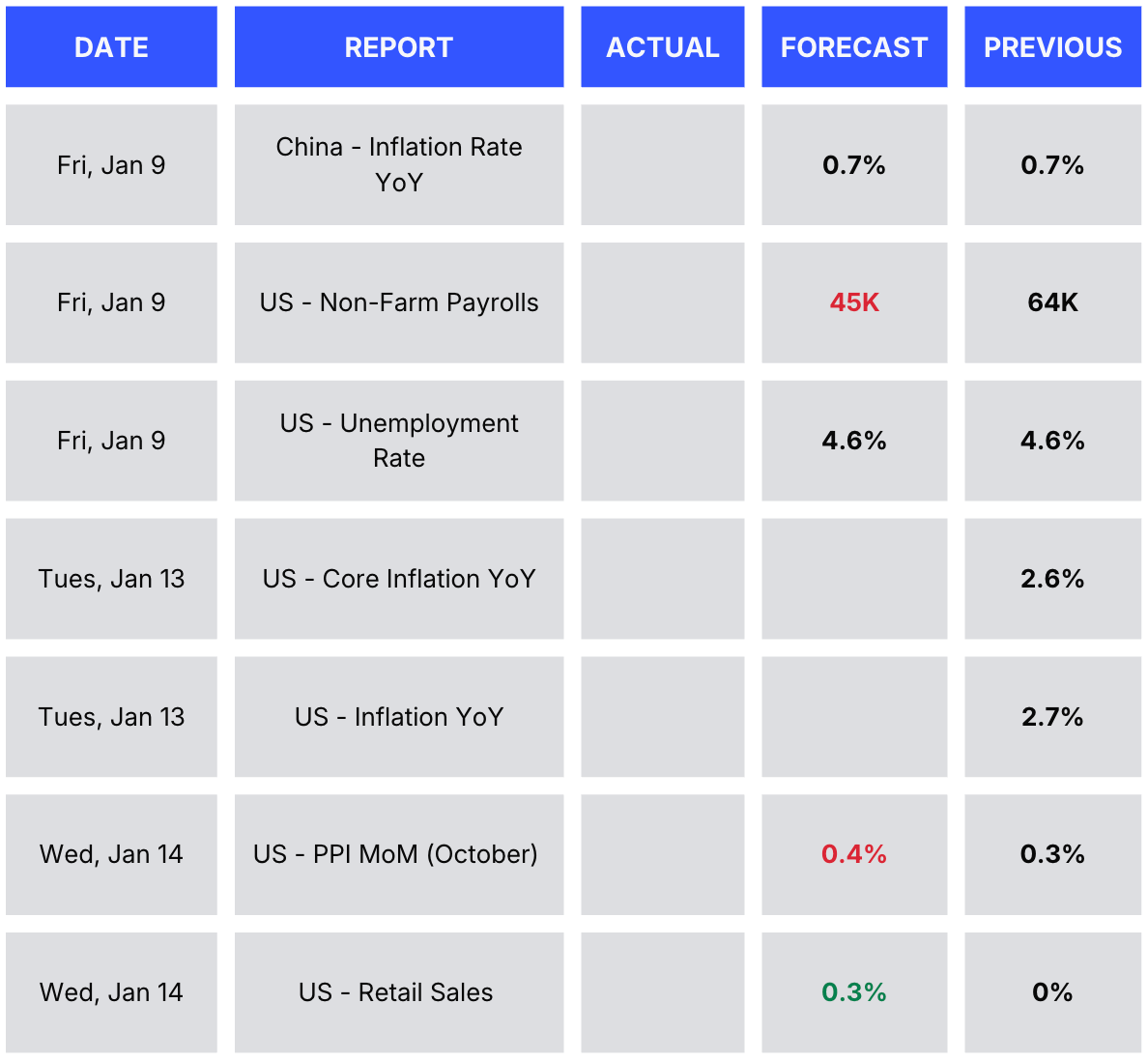

Risk assets have started the new year on a positive note, with crypto outperforming so far. Data-wise, we get European inflation today, which is expected to drop by 0.1% from its last reading to 2%. On Friday, we get US labour data, with non-farm payrolls expected to print softer and unemployment forecasted to remain stable at 4.6%.

Next week, all eyes are on US inflation data, where it will be crucial to see whether we get confirmation of further easing, as in the latest print, which came down to 2.6-2.7% from 3% previously.

Trades on Our Radar This Week🔥

Equities: LMT, CRML

Crypto: BTC, MNT, CC, ZEC, LINK, TAO, PENGU, FARTCOIN, XAN

Remember to take advantage of our holiday deals and get ready for the new year! Both promos run from December 15 → January 15, so take advantage before it’s too late!

🎁 Gift-a-Sub

Get a code to gift a free month to someone new. Share the alpha with a friend or family member.

How it works: Send them the link and code. It waives 100% of the first-month cost.

The Code: HOLIDAYS2025

The Link: https://whop.com/checkout/plan_gOfuiBD99Hkqt?a=mwizdom

⏳ 3-Month Bonus on Annual Plans

Buy or renew an annual subscription during the promo period, and we’ll add 3 extra months free.

Link for Annual Upgrade: https://whop.com/checkout/plan_udnPvrrpTqcDJ?a=mwizdom

Plan it. Alert it. Slam it.

✅ Read the trades

🔔 Set alerts

🎯 Time your entry

Table of Contents

MNT: short from 1.0469 to 0.9475, for +9.4% unleveraged CC: long with entry at 0.0946 hit 0.1776, for +87.7% unleveraged |

Disclaimer

Wizard of Soho LLC and Weekly Wizdom publish financial information based on research and opinion. We are not investment advisors and do not provide personalized, individualized, or tailored investment advice. Additionally, we do not offer legal advice or information. The publisher does not guarantee the accuracy of the information provided on this page. All statements and expressions presented are based on the author's or paid advertiser's opinion and research. Directly or indirectly, no opinion is an offer or solicitation to buy or sell the securities or financial instruments mentioned.

As news is ever-changing, the opinions included should not be taken as specific advice on the merits of any investment decision. Investors should conduct their own investigation and review of publicly available information to make informed decisions regarding the prospects of any company discussed. Any projections, market outlooks, or estimates herein are forward-looking and inherently unreliable. They are based on assumptions and should not be construed as indicative of actual events.

Contrarily, other events that were not considered may occur and significantly affect the returns or performance of the securities discussed herein. The information provided is based on matters as they exist on the date of preparation and does not consider future dates. As a result, the publisher undertakes no obligation to correct, update, or revise the material in this document or provide any additional information. The publisher, its affiliates, and clients may currently or foreseeably have long or short positions in the securities of the companies mentioned herein. They may therefore profit from fluctuations in securities prices. There is, however, no guarantee that such persons will maintain these positions. Unauthorised reproduction of this newsletter or its contents by photocopy, facsimile, or any other means is illegal and punishable.

Neither the publisher nor its affiliates accepts any liability for any direct or consequential loss arising from any use of the information contained herein. By using the website or any affiliated social media account, you consent and agree to this disclaimer and our terms of use.